Attractive employers offer 1e occupational pension benefits

With Tellco Pension Solutions 1e, you can offer your high-earning employees especially favourable pension options. This semi-autonomous collective foundation consolidates your individual management pension plan in the 1e solution within the scope of the non-mandatory occupational pension. You have a say in the investment strategies and benefits for the policyholders. 1e management pension plans are available for employees earning CHF 132,300.00 p.a. or more. Not only is the offer highly advantageous for your key individuals, it also offers multiple benefits to you, the employer.

Benefits for employers with 1e management pension plans

- 25% lower risk premiums on average

- Avoid accounting under IAS 19

- No risk of joint and several liability or restructuring obligations

- Increase your attractiveness as an employer

How your employees benefit from our 1e management pension plans

The appeal of 1e management pension plans to your employees is abundantly clear. Policyholders have the option of choosing their own investment strategy based on their personal risk profile and investment horizon. This makes it possible to optimise the return of their retirement funds for the long term. When you have an 1e management pension plan in place, the entire net income from the contained investments goes straight to your insured management employees. There is no risk of redistribution to other insured persons with management pension plans. Finally, as with all pension plans, any contributions made by you as the employer can be deducted from your total taxable income.

Customised investment strategy

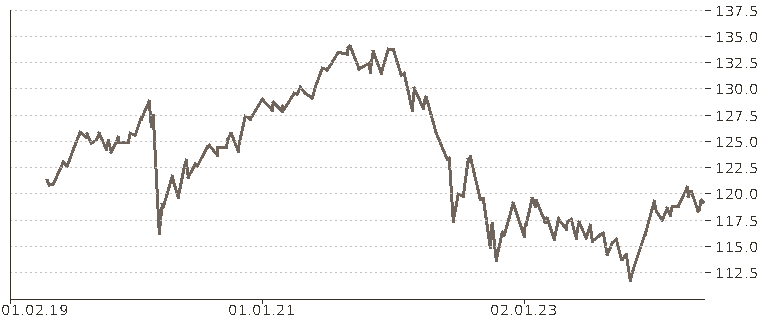

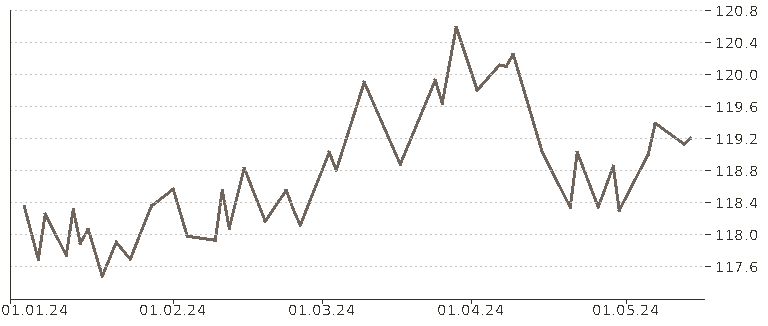

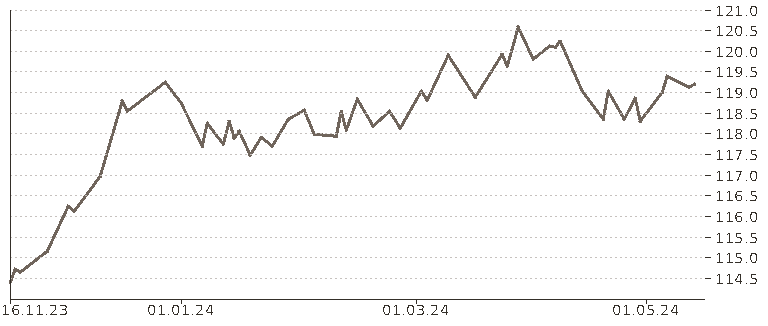

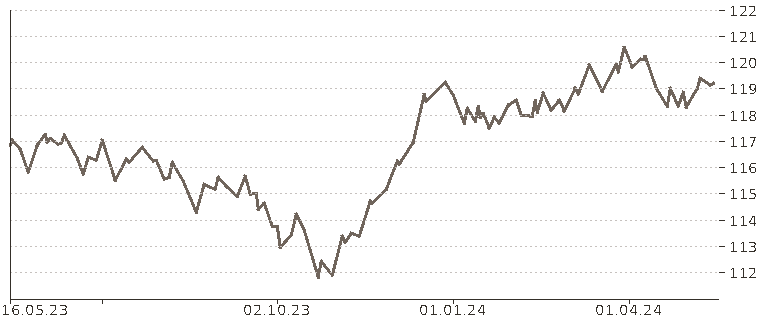

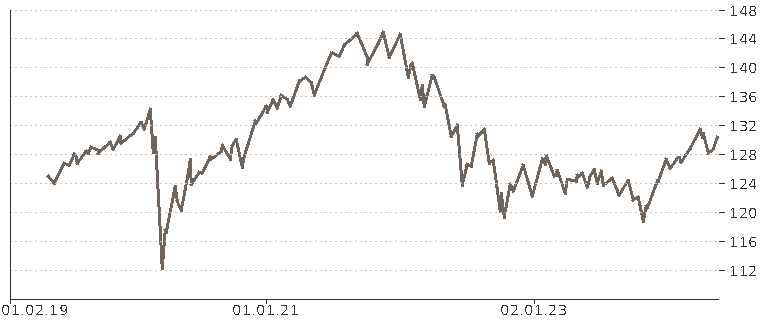

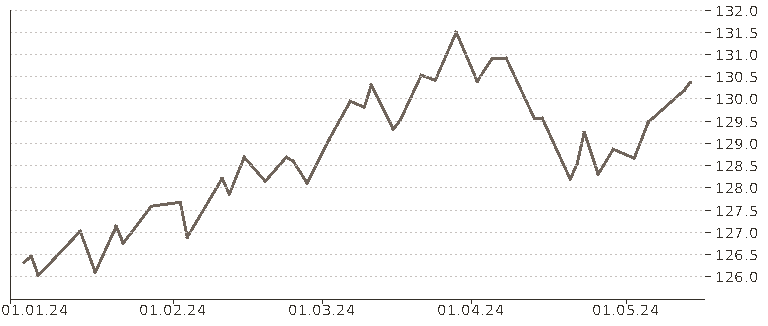

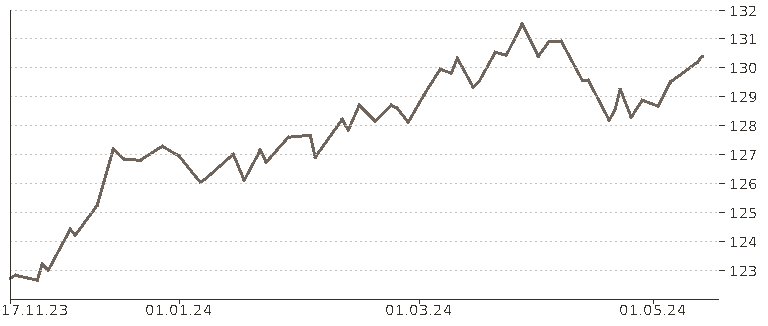

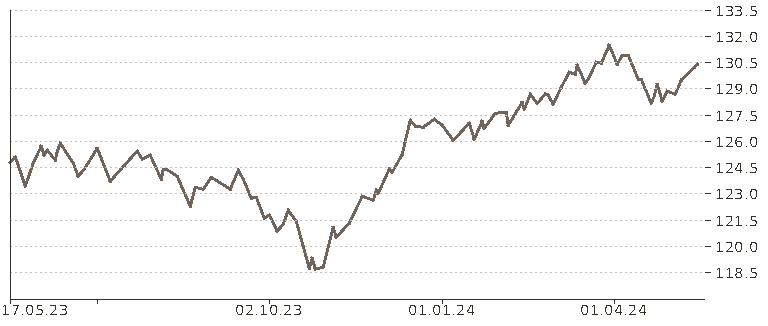

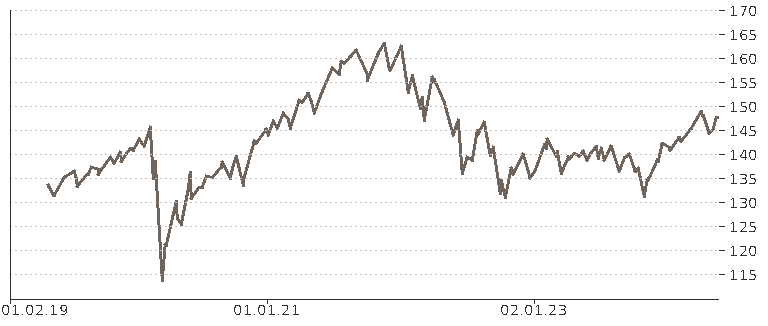

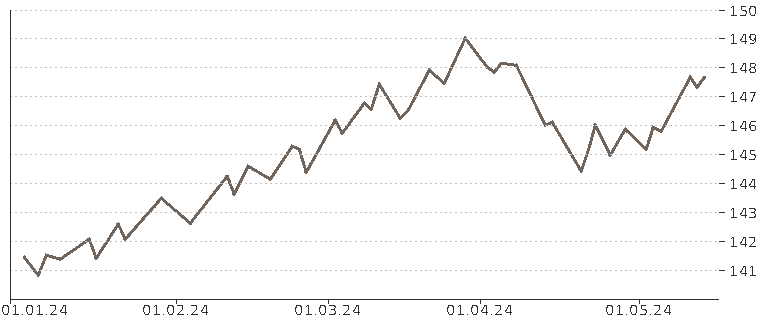

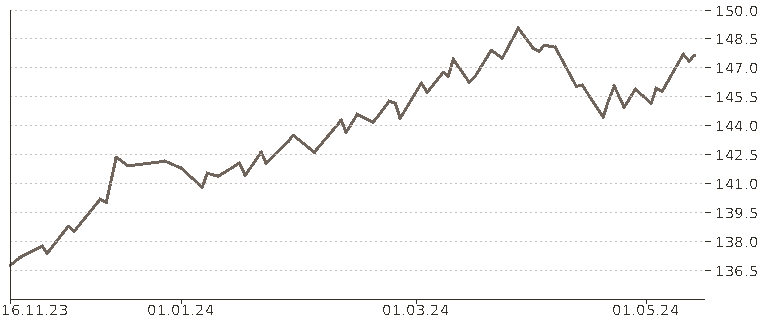

The pension provider offers its policyholders a selection of five different investment strategies. This allows you to choose the most suitable strategy for your own needs and strike your preferred balance between risk and returns. At Tellco, we know that your situation might change over the years. That is why you can always adapt your investment vehicle to your current needs, flexibly and hassle-free.

Greater return opportunities

Your savings contributions are invested in line with the strategy you choose. All returns are credited to the policyholder in full. When you exit the company or enter retirement, your full pension assets are paid out to you.

Effective pension assets

If a policyholder exits the company, they receive the effective value of their assets in full. If an insured employee changes to a different position or retires at an unfortunate time, there is no need to sell the investments immediately. Instead, they can be deposited temporarily with Tellco Bank Ltd or the Tellco Vested Benefits Foundation and sold at a later point in time when the market recovers.Tellco investment strategy for the 1e management pension plan

Find out more about Tellco Pension Solutions 1e

Our specialists will be pleased to provide you with tailored advice and illustrate the various options.