Invest to suit your taste

You can choose between a fixed-interest account or invest your pension assets either in whole or in part in securities. One way or the other, the important thing is that you end up with the investment strategy that actually reflects your needs and wishes.

The decision is yours. Moreover, since our needs change, you can also tweak the strategy at any time.

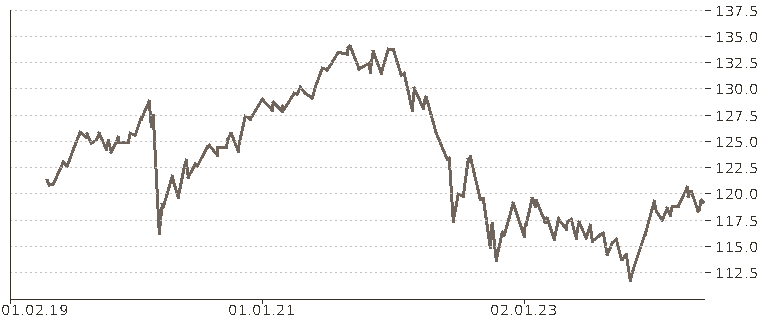

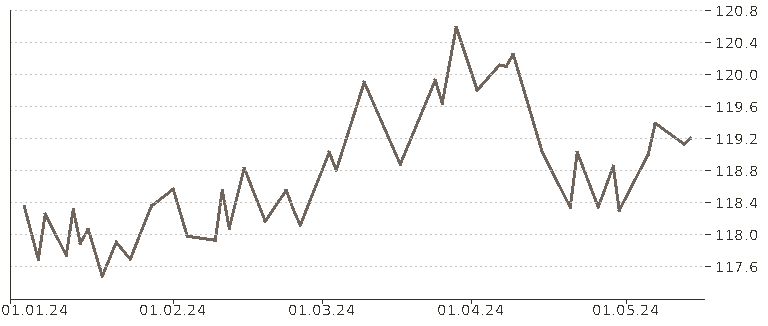

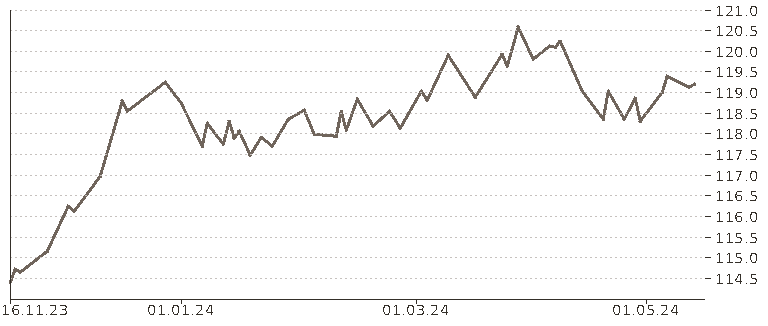

Our know-how, your profit: Tellco strategy funds

We offer four pre-packaged Tellco strategy funds. These balanced, globally diversified packages were chosen by our experts and have proved their worth. The Tellco Classic fund packages primarily differ in terms of the proportion of equities they contain.

Personal areas of focus with exciting thematic funds

Alternatively, you can choose one of the pre-packaged Tellco strategy funds and supplement it with thematic funds. In other words, you can opt for additional individual focus areas alongside your core strategy, thereby further customising your portfolio. Whether it’s healthcare innovation or even automation and robotics – you choose what you’re interested in and what’s close to your heart.

Individual strategy: a completely free hand

Want a fully tailored strategy? We offer you a variety of cost-effective exchange traded funds (EFTs). You can choose the investment funds yourself, creating your own strategy.

Not sure how to invest your retirement funds?

We’d be more than happy to answer this question and any others you have about investments and pensions. Our advice is bespoke and free of charge.

Your pension 3a funds

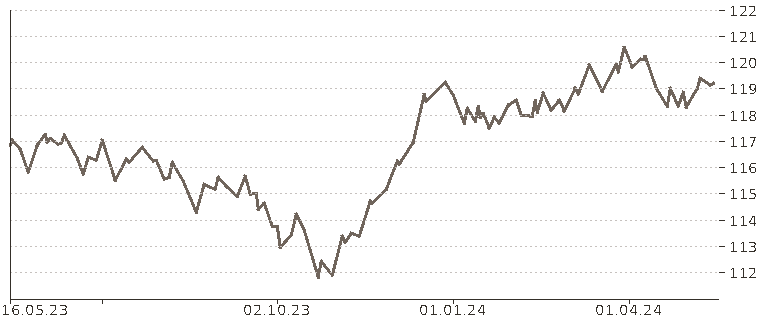

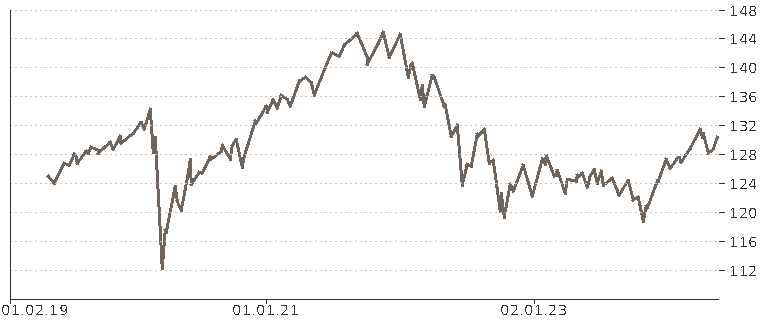

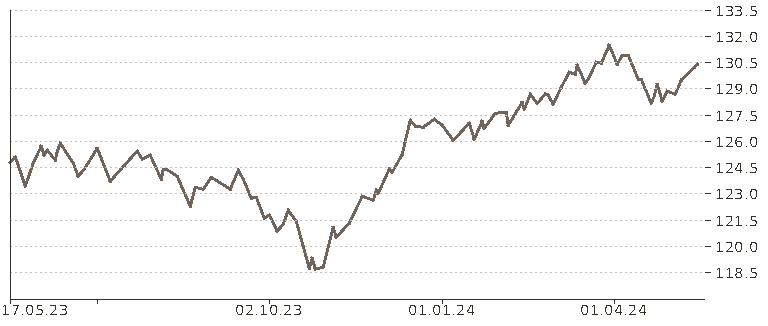

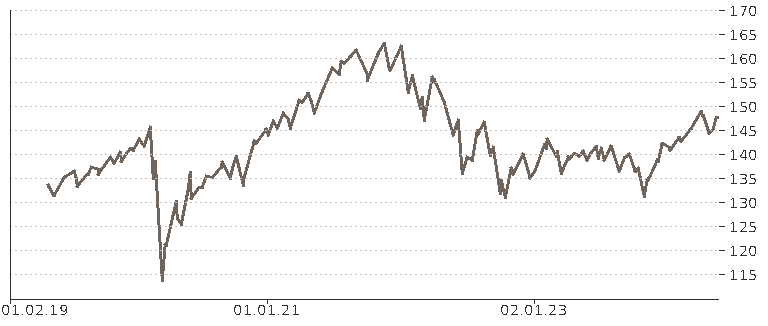

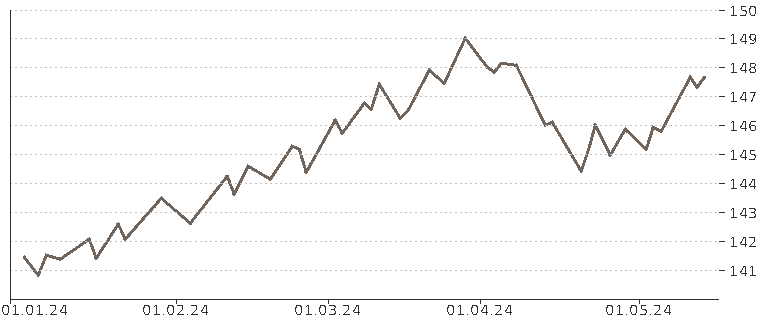

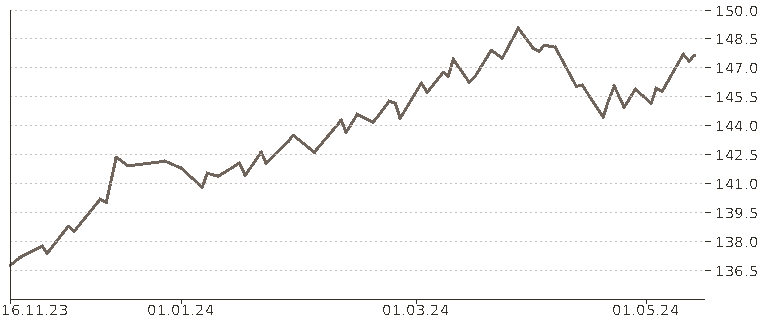

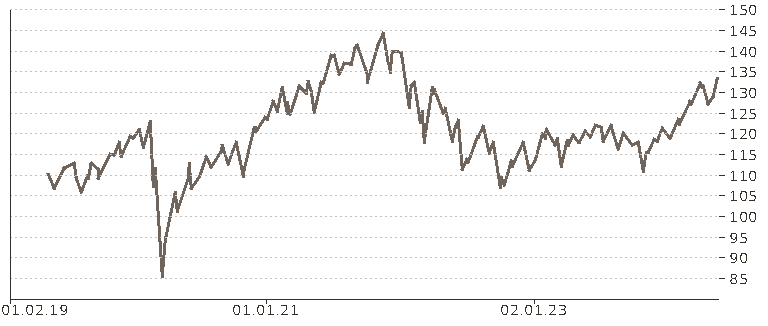

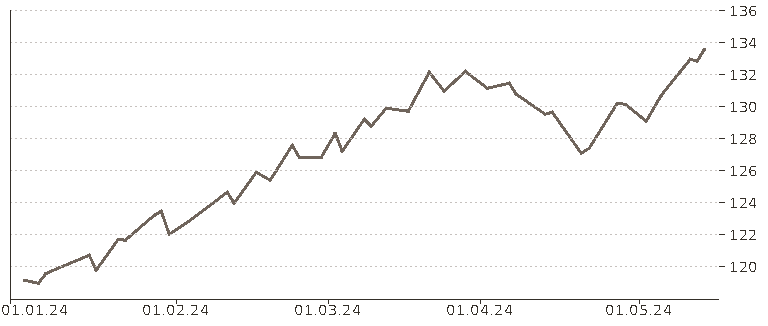

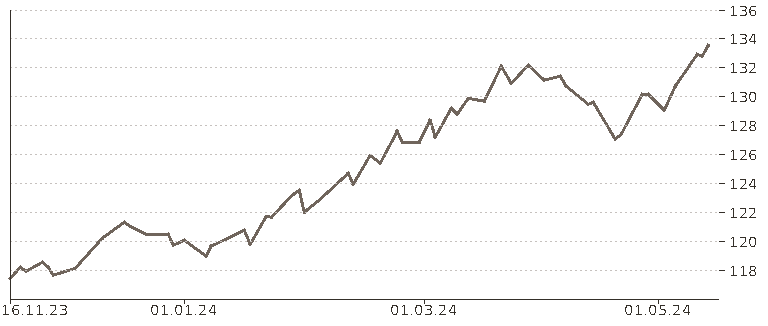

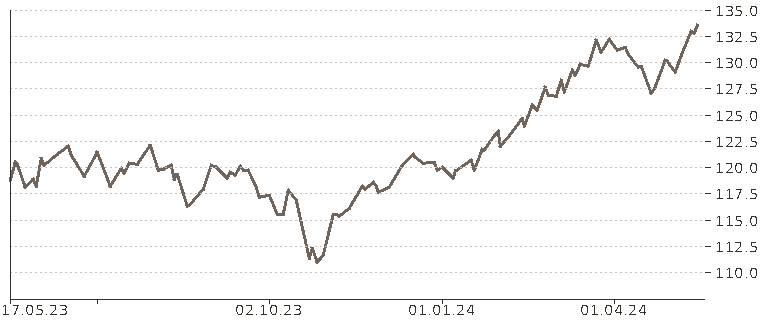

Tellco Classic funds for your core strategy

For your core strategy you can choose among four low-cost and broadly diversified Tellco investment strategies. You can invest up to 98 per cent of your entire portfolio in these strategies, which differ primarily in terms of the equity component:

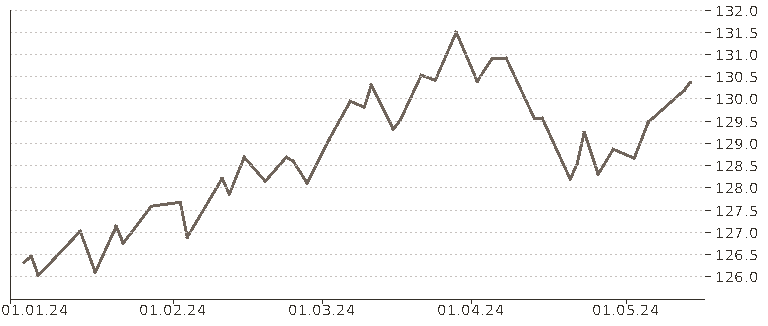

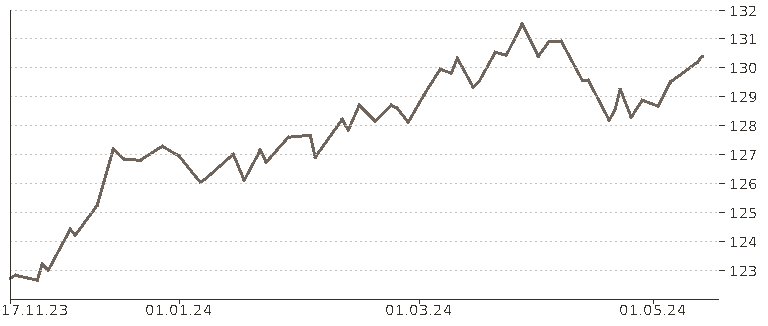

Exciting thematic funds: create your own personal focus.

If you wish, you can supplement your selected Tellco strategy fund entirely according to your personal interests with exciting thematic funds. This means you can invest in thematic areas that are particularly close to your heart or that reflect your interests. Since our needs change, you can also tweak the thematic funds at any time:

Ageing Population

Longer life expectancies are one of the effects of demographic and social change. This opens up opportunities for investors.

ISIN: IE00BYZK4669

Factsheet

Automation and Robotics

The automation of processes and the use of robots have increased substantially – including in areas where the work at hand can be dangerous for humans.

ISIN: IE00BYZK4552

Factsheet

Healthcare Innovation

Medical advances and higher life expectancies leave companies facing ever greater challenges, but they also open up groundbreaking opportunities.

ISIN: IE00BYZK4776

Factsheet

Digitalisation

Digitalisation is proceeding apace, simplifying our life in many ways. There is undeniably still a huge amount of potential in this area.

ISIN: IE00BYZK4883

Factsheet

Clean Energy

limate change is one of the biggest challenges facing society, making renewable energies indispensable. This opens up new opportunities.

ISIN: IE00B1XNHC34

Factsheet

Blockchain

Blockchain technology is becoming increasingly important in line with advancing digitalisation. In addition, there is a diverse and extensive range of possible applications.

ISIN: IE00BGBN6P67

Factsheet

The investment opportunities exclusively comprise collectively managed capital investments that are admitted for distribution in Switzerland by the Swiss Financial Market Supervisory Authority FINMA and are either subject to the supervision of FINMA itself or were set up by Swiss investment foundations.

Want a tailored strategy?

We offer a variety of selected cost-effective investment products for experienced investors so you can shape your personal portfolio just the way you like it. Get in touch: we would be happy to advise you free of charge.

Selected for you using our extensive expertise: you can find an overview of our selection of investment funds here.

Set up your 3a pension now, simply and securely!

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/7/0/csm_tellco_pk_aktuelles_einkauf_pensionskasse_59ad27c08f.jpg)